| |

|

ZetaTalk Chat Q&A for December, 2025

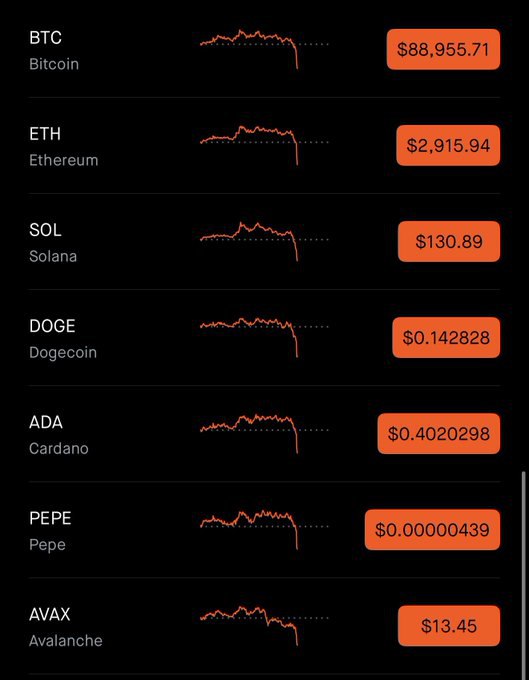

Bitcoin falls again after weak November as bearish sentiment goes on December 1, 2025 https://www.reuters.com/business/finance/bitcoin-falls-5-below-90000-investors-ditch-risk-assets-2025-12-01/ Bitcoin slumped on Monday, with the world's largest cryptocurrency down about 6% and on track for its biggest daily percentage fall since early November, as risk aversion drove investors out of digital and other assets. [and from another] Cryptocurrency Craze February 4, 2018 https://www.zetatalk.com/newsletr/issue592.htm The Bitcoin craze which started in 2009 has now spread to other, newer Crpytocurrencies, all likewise unregulated. [and from another] https://poleshift.ning.com/profiles/blog/show?id=3863141%3ABlogPost%3A585355&commentId=3863141%3AComment%3A1168940&xg_source=activity The crypto market suffered a sharp downturn on December 1, 2025, with over $400 million in liquidations occurring in just one hour. Bitcoin and other major cryptocurrencies saw steep price drops, triggering widespread concern across the market. [and from another] Market Crash May 29, 2022 https://poleshift.ning.com/profiles/blogs/zetatalk-newsletter-as-of-may-29-2022 How safe is your savings account at the bank? If under $100,000 the FDIC will guarantee these funds if your bank goes belly up. What about Bitcoin or other cryptocurrencies? They are ephemeral and could disappear overnight. The Zetas call the debt based system that banks operate a Paper Promise – ephemeral. The Zetas have predicted that bank failure will be endemic, with the globe turning to the Barter System instead. [and from another] President Donald J. Trump Establishes the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile March 6, 2025 https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-establishes-the-strategic-bitcoin-reserve-and-u-s-digital-asset-stockpile/ The Order creates a Strategic Bitcoin Reserve that will treat bitcoin as a reserve asset. The Strategic Bitcoin Reserve will be capitalized with bitcoin owned by the Department of Treasury that was forfeited as part of criminal or civil asset forfeiture proceedings. The United States will not sell bitcoin deposited into this Strategic Bitcoin Reserve, which will be maintained as a store of reserve assets. The Secretaries of Treasury and Commerce are authorized to develop budget-neutral strategies for acquiring additional bitcoin, provided that those strategies impose no incremental costs on American taxpayers.

We predicted when Bitcoin and other cryptocurrencies first emerged that

they would prove to be vulnerable and thus

ephemeral. Cryptocurrencies are not backed by any country,

thus the system can go poof with no one held

accountable. Unlike the USD, which the FDIC guarantees up to

$100,000 if a bank fails, or where a Plunge Protection Team can calm a

plunge, cryptocurrencies have no brakes. They promise quick profits but

also hold great risk.

But President Trump has addressed the reality of Bitcoin and other cryptos

with his Strategic Bitcoin Reserve to hold any Bitcoin arriving as a

result of a civil suit. Where the USD or other currencies might plunge in

value to the extent that they are no longer used as a medium of exchange,

Bitcoin is likely to remain as a link between Central Bank supported

currencies and a frank Barter System.

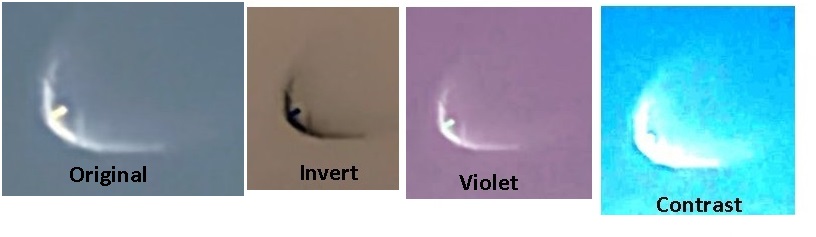

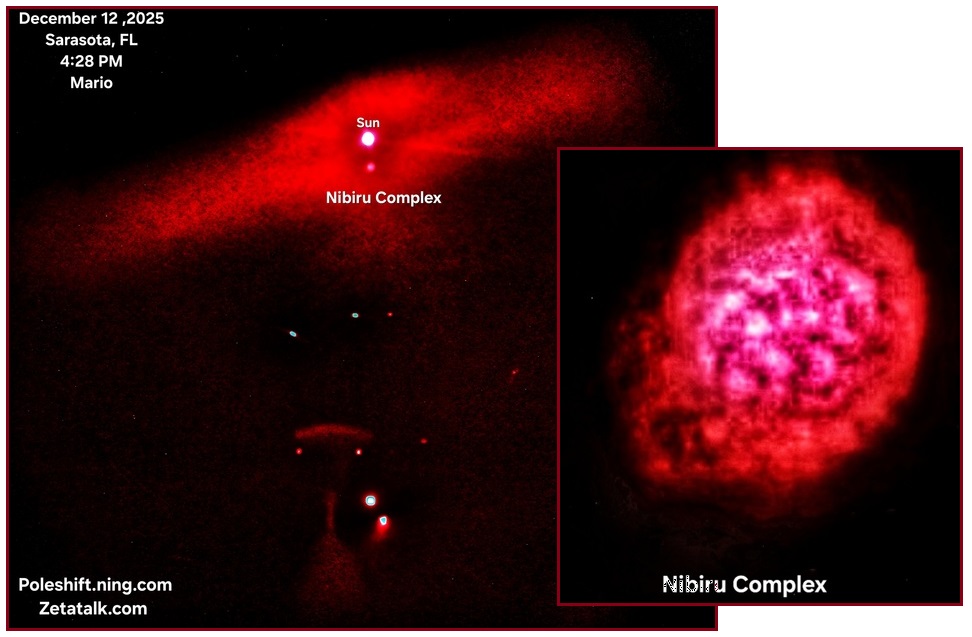

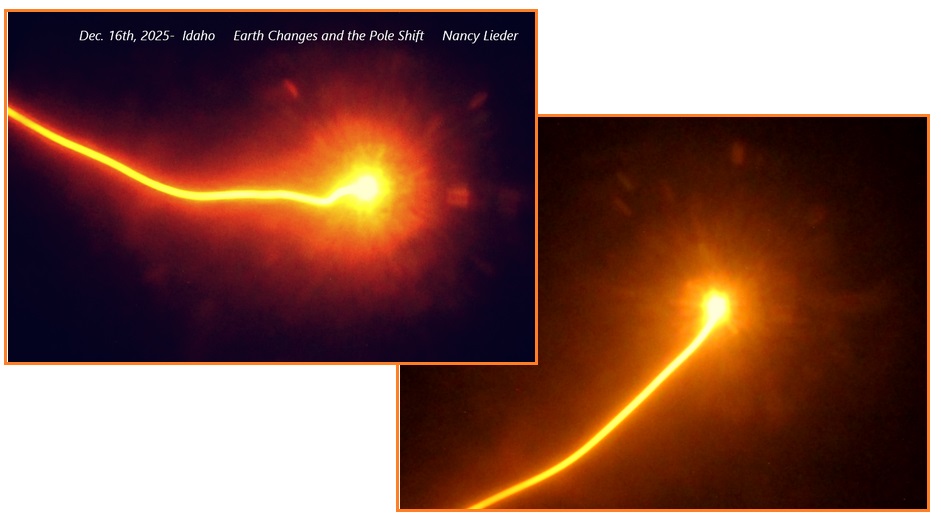

Is this Nibiru? [and from another] https://www.instagram.com/p/DR5AhuigdB-/ A BIZARRE SKY OBJECT JUST APPEARED OVER THE PACIFIC — AND THE VIEWER CAUGHT IT IN REAL TIME A viewer said they glanced out their bedroom window and saw this strange, glowing object moving through the southwest sky above the Pacific Ocean. What makes this unusual is the curved, comet-like trail behind it — bright, defined, and holding its shape long enough to be photographed. No sound. No flashing aircraft lights. Just a silent, illuminated arc cutting through the sky in a way that doesn’t match a plane, drone, or meteor. The movement, the shape, the trail… all of it raises questions. Has anyone else seen this strange sky object over the Pacific? #MrMBB333 #SkyPhenomenon #PacificMystery #CaliforniaSky #EnergyInTheSky

This is Nibiru with its two Dominant Moons on either side each with their own entourage of minor moons. The Nibiru Complex is also rotating counter clockwise which can be seen from the direction the haze of dust in their tails is blowing away. This image passes the Pixel analysis, not a doctored cut and paste job. This shows the closeness of Nibiru to Earth at this time, with heightened visibility as predicted. Let the frantic debate of the Nibiru Coverup crowd begin.

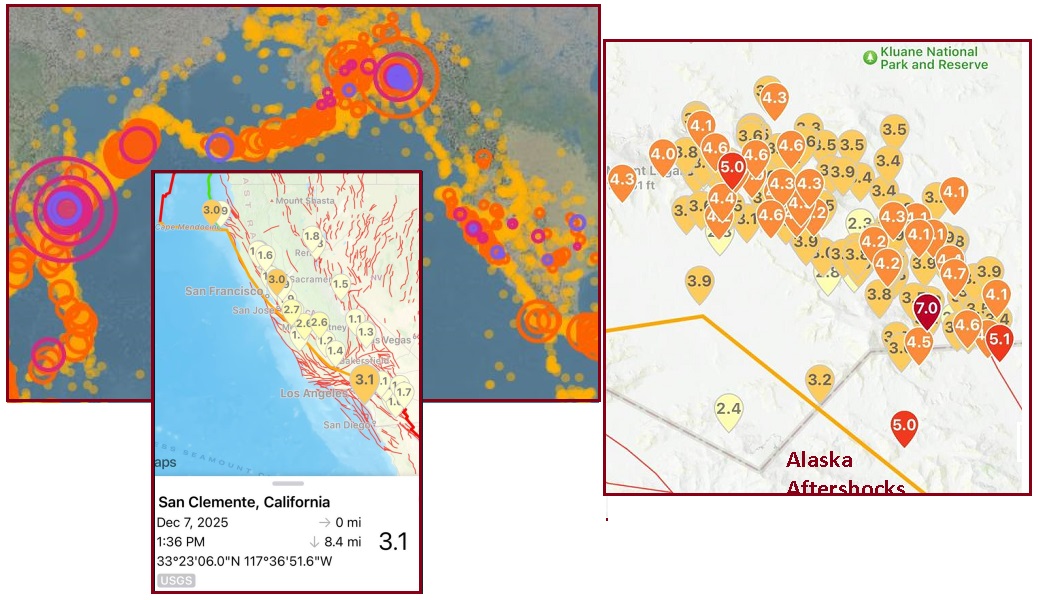

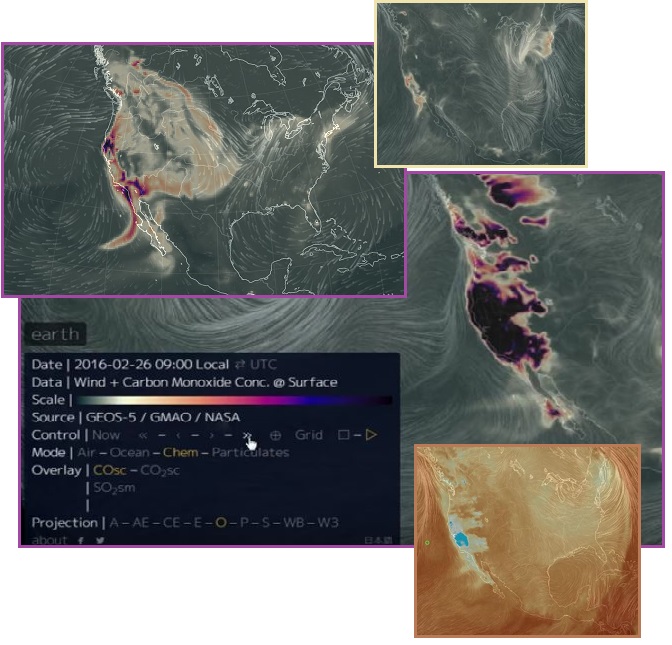

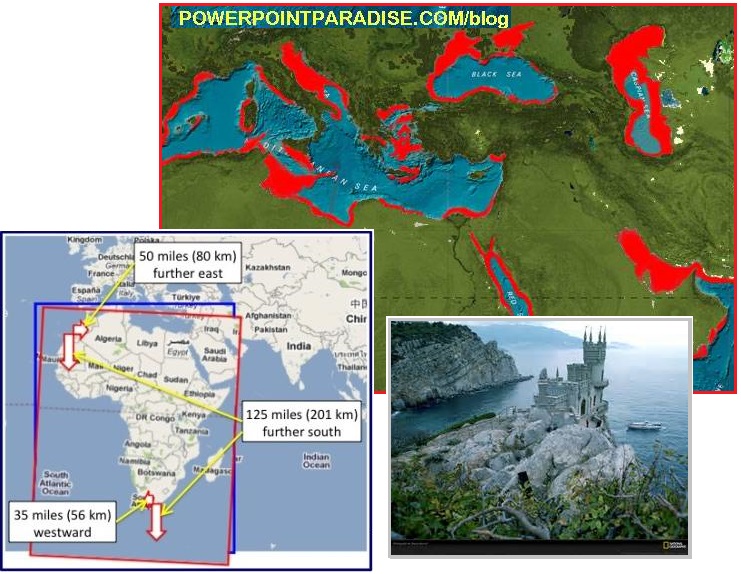

Is this the West Coast Adjustment during the New Madrid? [and from another] New Madrid Sequence June 5, 2022 https://www.zetatalk.com/newsletr/issue818.htm Currently the Mainland Portion of N America is sliding to the SW, relaxing the bow shape that had been imposed on it since 2009. This bow tension could be seen in the CO and SO and Methane released from the rock under bow stress on the West Coast in 2013. [and from another] West Coast Restless August 3, 2025 https://www.zetatalk.com/newsletr/issue986.htm The Zetas predicted that as the New Madrid Rupture releases its hold along the Fault Line, that the Mainland will slide to the SW. They predicted the San Andreas slip-slide will get more active, and volcanoes like Mount St. Helens will erupt, and that the Hoover Dam would find its spillways jamming. Has this action begun? The animals at Yellowstone certainly are starting to flee.

The New Madrid Fault Line adjustment is

iterative, a sequence completing and then another starting. Plate

movements elsewhere can start a sequence, such as the African Roll

torquing Africa to drop its NE corner, pulling the attached SE Portion of

the N American Continent with it. Another Plate Movement that can incite a

sequence is compression of the Pacific due to the Eurasia Plate sliding

into the Pacific. Clearly within the past few days both a spreading

Atlantic and compressing Pacific occurred.

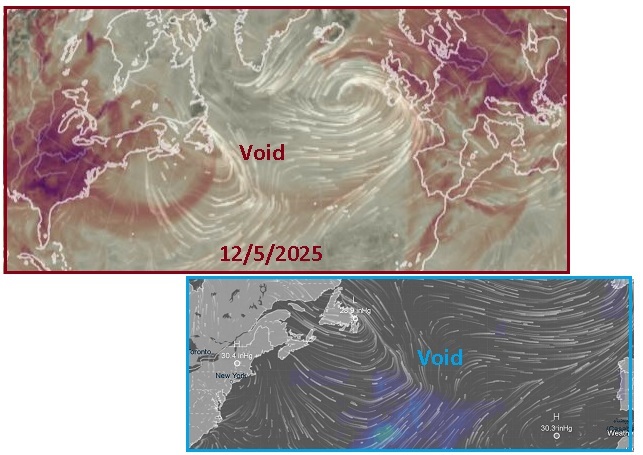

On 12/5 The Void in the N Atlantic pulled open as the Eurasia Plate was

pulled east, and on 12/8 a quake swarm in Alaska and down to Japan

indicated the Mainland Portion of the N American Plate was moving during a

San Andreas slip-slide. This is not the New Madrid finale nor will it be

the last sequence, but it is a warning that the West Coast quakes and

volcanoes and the collapse of the Hoover Dam await. More to come.

UFO whistleblower says Trump has been fully briefed on the alien presence. I was wondering if the Zetas cared to comment on this article? [and from another] UFO Whistleblower Claims Trump was 'Fully Briefed' on Alien Hybrids Living Among Humans December 8, 2025 https://www.dailymail.co.uk/sciencetech/article-15363981/UFO-whistleblower-Donald-Trump-evidence-non-human-intelligence.html In a recent interview, whistleblower and retired US Air Force Major David Grusch claimed that Trump has received reports on crashed spacecraft and non-human remains retrieved by the US, the origins of these beings, and their intentions. Grusch, a current advisor to Congress's UAP Task Force, said the president could soon become the 'most consequential leader in world history' by publicly disclosing what America has kept hidden about extraterrestrials. [and from another] https://youtu.be/Hx3ond0SzPQ Is Skinny Bob real? This is a Roswell survivor, and is a genuine live alien! Note the many similarities to the ZetaTalk face and drawings done by Nancy Lieder. Is there any doubt she is a contactee? [and from another] https://www.youtube.com/watch?v=kPheat9ITAw The Zeta Report 65, August 12, 2014 on YouTube - Glimpses of alien bodies are increasingly captured on video. This trend was predicted by the Zetas. What’s next? Will they walk up and shake your hand?

Of course aliens are visiting Earth and over half the human inhabitants

are contactees, chatting away with these visitors. They come in all shapes

and sizes from hominid to every lifeform known on Earth. Why isn’t the

truth out there? There are several reasons, one being that the CIA and

other intel organizations want to reverse engineer the alien technology

before they get competition from the general public. Another reason is the

CIA is spreading the story that aliens are evil, to keep the common man

from chatting with them.

In that humans subconsciously know the alien presence is real, the CIA is

losing this battle. There are many photo captures of aliens on the

Internet already. Soon it will not matter if official disclosure is

provided, it will be just another secret the government was reluctant to

share. We have predicted that sightings of alien bodies will increase, and

certainly during times of trauma such as the coming Pole Shift this wlll

occur. They will come to help, and no one will be surprised.

I have noticed recently that other than the Nibiru Complex. I have been capturing more details of what I am assuming are moon swirls and other debris now that the Nibiru Complex visibility is increasing or is there something else happening within the picture also that is worth noting. Thanks

These images are in 2D and thus show the scene at a distance as well as

the scene playing out on the outer edge of the Earth’s atmosphere which is

increasingly hosting burning Petrol which has just gained enough oxygen to

burn. Nibiru is centered below the Sun, with the vast tail wafting to the

left and right as well as dropping below toward Earth. As Nibiru draws

closer, details such as the Dominant Moons on either side will be seen in

more detail.

The large orbs amid a burning Petro Storm below are not planets but a fire

storm from burning Petrol on the Atmosphere’s surface. This is the

confusion engendered when seeing images in 2D when they include both near

and far objects. Eventually the Petrol Storm on the surface will even out

and become Sky Glow from horizon to horizon, accompanied by a fog horn

sound from the vibrating atmosphere being heated and cooled repeatedly in

succession.

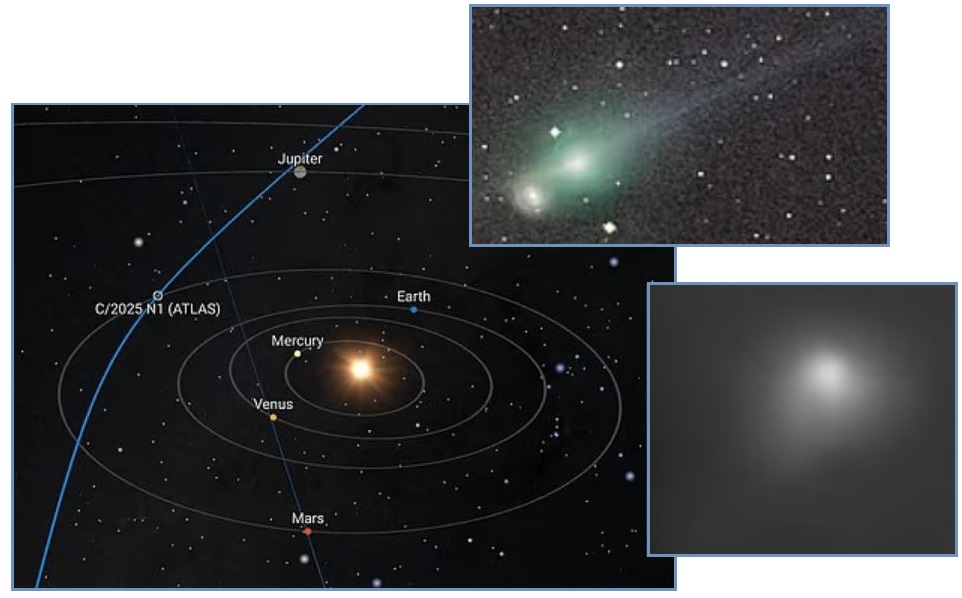

Space Agency Activates its Largest Planetary Defense Drill as Interstellar Visitor Approaches Earth December 15, 2025 https://www.dailymail.co.uk/sciencetech/article-15385317/planetary-defense-drill-interstellar-visitor-3i-atlas.html The European Space Agency (ESA), NASA, and more than 23 nations have launched the largest drill in history which will run through January 2026, using the suspected comet's harmless passage through the solar system as a test for tracking future threats from space. 3I/ATLAS is expected to come within 170million miles of Earth on Friday, and space agency officials have said there is no risk of a potential collision with the interstellar object. However, this relatively short distance from our planet (roughly twice the distance between the Earth and the sun) is being used to sharpen the detection of high-velocity near-Earth objects (NEOs) that could one day impact the planet. [and from another] Blame the Sun April 5, 2009 http://zetatalk.com/newsletr/issue127.htm Right on cue, showing that NASA intends to have the electromagnetic bombardment from the tail of Planet X blamed on the Sun, is this article relating this effect to 2012, the end of the Mayan Calendar. Per the Zetas, it has long been the plan of the establishment to blame the Sun, but electrical disturbances going into the pole shift will not be caused by the Sun, they will be caused by the charged tail of Planet X.

For many years the main excuse for EMP from Nibiru was to Blame

the Sun, while the Daily Earth Wobble was ignored. Now the main

excuse for Nibiru visible is the Atlas comet which is emerging from behind

the Sun at present. This excuse may hold for the month of December and

into early January but will quickly fade after that as Atlas is projected

to zoom to the right, out toward Jupiter, while Nibiru is taking a

position centered in front of the Sun. Compare the photos of Atlas to the

Nibiru photos with Dominant Moons featured on the MrMBB333 site weeks ago.

This excuse buys the Nibiru Coverup another month at most while in the

mean time preparations for Martial Law proceed. Nibiru will become closer,

the details in the Complex evident from the Dominant Moons in a helix on

either side to the many String of Pearls arrangements within the

Complex. Debate in the alternative media will continue. Social Media will

be shut down and the subject banned, while Martial Law continues to be

imposed on the creep. We have predicted that by April the truth will be

out of control.

A question for the Zetas. Today I am using a solar filter like the ones used to view an eclipse of the Sun. In between shots we see these lines shooting out. Would the Zetas care to elaborate what this phenomena is for us? [and from another] Nibiru Lightning Jan 13, 2019 http://www.zetatalk.com/newsletr/issue641.htm The charged tail of Nibiru above, the electronic screech from distressed rock below. And in between? Lightning. The Zetas have predicted a massive lightning storm between the Earth and Nibiru during the hour of the Pole Shift, wherein lightning silently moves from the Earth to Nibiru, without flash or crackle as there is no oxygen or atmosphere between the planets. But at Nibiru, in its upper atmosphere, there will be a lightning show, and for the Earth there will be upper atmosphere trumpets, known as the Thunderbolts of the Gods, and odd plasma figures in the sky.

This is arcing from the Sun to Nibiru’s charged tail. Ordinarily, the tail is overshadowed by the glare of the Sun, but with the solar filters this glare is reduced to allow more detail. These arcs are reaching toward Earth, in 2D, and Nibiru is at the orbit of Venus, so the arcs are visible and nearby. Nibiru is below the Sun but has a retrograde (clockwise) rotation so the tail is wafting to the left. We have predicted lightning between Nibiru and Earth during the Passage.

Trump Removes Nearly 30 Career Diplomats from Ambassadorial Positions December 22, 2025 https://apnews.com/article/diplomacy-ambassadors-state-department-1a10058998c86e799ce4e5132a99da18 All of them had taken up their posts in the Biden administration but had survived an initial purge in the early months of Trump’s second term that targeted mainly political appointees. Africa is the continent most affected by the removals, with ambassadors from 13 countries being removed: Burundi, Cameroon, Cape Verde, Gabon, Ivory Coast, Madagascar, Mauritius, Niger, Nigeria, Rwanda, Senegal, Somalia and Uganda. Second is Asia, with ambassadorial changes coming to six countries: Fiji, Laos, the Marshall Islands, Papua New Guinea, the Philippines and Vietnam affected. [and from another] Trump says US 'Has to Have' Greenland after Naming Special Envoy December 23, 2025 https://www.yahoo.com/news/articles/trump-envoy-greenland-sparks-fresh-122657921.html Donald Trump has sparked a fresh row with Denmark after appointing a special envoy to Greenland, the vast Arctic island he has said he would like to annex. In response to a question from the BBC about the new role of Jeff Landry, the Republican governor of Louisiana, Trump said the US needed Greenland for "national protection" and that "we have to have it". Landry, he said, would "lead the charge" as special envoy to Greenland, a semi-autonomous part of the Kingdom of Denmark.

This sudden and sweeping forced resignation of career diplomats just days

before the end of the year indicates something momentous is about to be

revealed. We warned that the focus on Comet Atlas would only temporarily

explain the increasing evidence that Nibiru was front and center

under the Sun. That those being removed are diplomats appointed during the

Biden Administration is a clue, as the Biden Administration was firmly

committed to denying Nibiru in of support the Israel banking empire. With

the reveal that Epstein worked for the Zionists to collect blackmail

material, these diplomates are singing the wrong tune.

The Council of Worlds has warned the Trump Administration and his Junta

that continued stalling will not be allowed. Surprises await, and within

the month of December. The reveal of Nibiru will have a global

impact, where all countries are dealing with panic-stricken citizens

making demands on their governments or suddenly fleeing to safer ground. A

steady and consistent message being issued from the Trump Administration

is required, and any confusion being sowed by Biden Administration

hangovers must be eliminated.

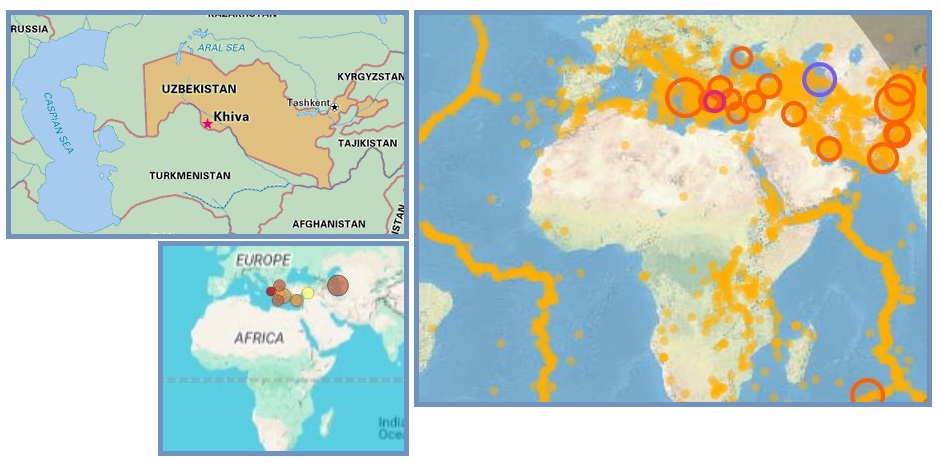

Hello! I live in Tashkent, in our Furkat Park area for two weeks now, gurgling sounds have been heard periodically, and not only outside the window, but also at a distance of 2 kilometers, within a radius of the house (well, if we walk to the pharmacy, then to the market, these sounds are everywhere along the way) maybe further, too, but we don't go any further. Could the Zetas comment on the source of this sound, it sounds like dripping water, but it comes from everywhere, we have never heard such a sound before. [and from another] Rising and Sinking Land February 16, 2015 https://www.zetatalk.com/newsletr/issue437.htm The Black Sea turned from a fresh water sea to a salt water sea approximately two Pole Shifts back - 7,200 years ago. This was once again due to further sinking of the Mediterranean floor, the African Plate border tearing away.

This is a clear sign the water table is rising, ie the land is sinking. As the Africa Roll proceeds, it pulls the NE corner of the Africa Plate down, stretching the land above thin so it drops. The Caspian Sea and even the Mediterranean formed during prior Passages of Nibiru. The earthquakes in the area show the progress during this Passage. The gurgling water table is a warning that flooding will likely occur. Move to higher stories in your buildings or form houseboat communities.