|

Bitcoin Bubble

From the start, the Zetas advised that Bitcoin and other

currencies were risky. Unlike the USD cryptocurrencies are not

regulated, and if one has been injured and wants to sue, who to

sue? Deposits in US banks are insured by the US government for

$250,000 but not so for cryptocurrencies most often living in

servers in people’s basements. Poof. Gone.

ZetaTalk Confirmation

12/7/2013: Bitcoin

is a recent phenomenon wherein funds are converted from one

currency to another, and passed via the Internet. A virtual

bank, its popularity has increased because there is no

apparent physical location where the funds can become

entangled and no way for the tax man to easily trace the

funds. On the flip side, it’s virtual money, and thus can

disappear along with the Internet. Bitcoin will not outlast

the Internet, which will falter during the Pole Shift and

essentially disappear. But Bitcoin is a step closer to the

barter system than traditional banking.

The barter system, which we

have predicted will replace the paper money system, will

thrive. This will arise naturally and gradually, as mankind is

familiar with the barter system from antiquity and the worth

of the item is obvious. Banks become more particular about

loaning funds, worried about repayment, so the populace starts

to look outside of the banks. A farmer needs a new tractor and

swaps for an old truck. In all of this, where does Bitcoin

fall? This is a currency without a country to collapse into

bankruptcy, a bank with scant banker salaries as an overhead

to pay, and a currency capable of adapting to the exchange

rate almost instantaneously. As long as the Internet

functions, Bitcoin is likely to do so also.

What could go wrong? The

success of Bitcoin has inspired copycats. Cryptocurrencies

without the inherent checks and balances of Bitcoin have

emerged, and fraud and theft and bankruptcies have emerged

right behind them. Unlike national currencies, where the

government of a country stands behind the bills they print,

Bitcoin and other Cryptocurrencies have only a network of

servers that can be hacked and corrupted. A country can go

bankrupt and its currencies become almost worthless, but one

knows where to go to demand repayment. Not so for Bitcoin

which can go poof.

Cryptocurrencies have been compared to a Ponzi Scheme, as unless

more and more people are attracted to their use, they can lose

their value.

- Ponzi Schemes Explained: Legal

Definition and Key Insights

https://legal-resources.uslegalforms.com/p/ponzi

- A Ponzi scheme is a type of

investment fraud that promises high returns with little

risk to investors. Named after Charles Ponzi, who became

infamous for such schemes in the early 20th century, it

operates by using the funds from new investors to pay

returns to earlier investors. This creates the illusion of

a profitable business, but in reality, no legitimate

investment is taking place. Eventually, the scheme

collapses when it becomes impossible to recruit enough new

investors to pay returns to earlier ones.

- Market Crash

May 29, 2022

https://poleshift.ning.com/profiles/blogs/zetatalk-newsletter-as-of-may-29-2022

- How safe is your savings account

at the bank? If under $100,000 the FDIC will guarantee

these funds if your bank goes belly up. What about Bitcoin

or other cryptocurrencies? They are ephemeral and could

disappear overnight. The Zetas call the debt based system

that banks operate a Paper Promise – ephemeral.

The Zetas have predicted that bank failure will be

endemic, with the globe turning to the Barter System

instead.

ZetaTalk Confirmation

1/31/2018: Following the success of Bitcoin

to establish itself as a virtual currency, there has been a

plethora of Cryptocurrencies emerging. Fraud and bankruptcies

have followed. Are these new Cryptocurrencies safe and stable?

No, nor is Bitcoin immune from fraud or a sudden collapse

either. Paper money is backed by the country printing this

money, with the currency exchange rate showing the relative

worth and stability. If a country is faltering this can be

seen long before a crash. And there is always an accounting

eventually, where the essentially worthless paper money is

exchanged for something of worth.

But Cryptocurrencies do not

have backing from a country, and are not housed in a bank that

might be backed by a country. In the US, this is known as the

FDIC, where savings accounts are backed up to $100,000 in case

of bank failure. Who does that for Bitcoin? The worth resides

on a series of servers, owned by individuals, who invest to

establish this repository and then collect a transaction fee.

These individuals perform a series of checks and balances

against each other, to prevent blatant theft.

Most of the new Cryptocurrencies are being established to

eventually steal from the public. The schema is to allow the

currency to go into use, encouraged by celebrities or chirpy

reports on how easy the new currency is to use, then boom

anyone holding the electronic currency suddenly finds it has

zero worth and cannot be redeemed. Bitcoin touts its safety

saying it has not yet been hacked. But all computers can be

hacked, when the prize is large enough. To date Bitcoin

servers have only held small change, so have not been worth

the effort.

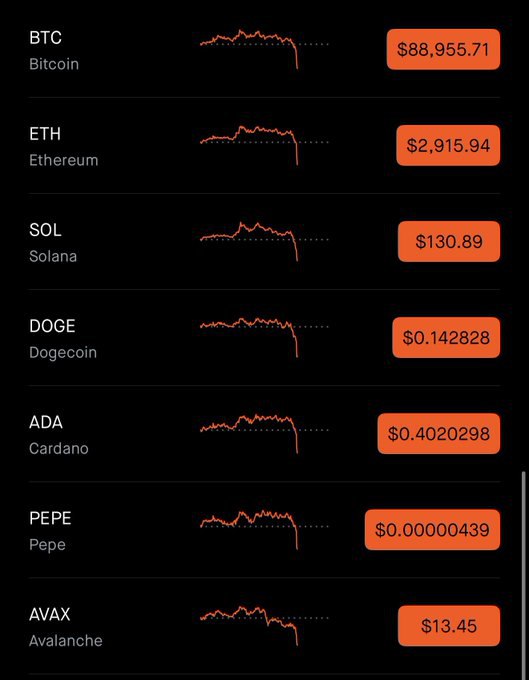

Now in 2025 we have had a Bitcoin and other cryptocurrency

crash, of sorts. Just a hint of what may be coming. But the

Zetas say during a time when the USD has slipped in comparative

value, Bitcoin and its brethren have their place.

- Bitcoin falls again after Weak

November as Bearish Sentiment Goes On

December 1, 2025

https://www.reuters.com/business/finance/bitcoin-falls-5-below-90000

- Bitcoin slumped on Monday, with

the world's largest cryptocurrency down about 6% and on

track for its biggest daily percentage fall since early

November, as risk aversion drove investors out of digital

and other assets.

- Cryptocurrency Craze

February 4, 2018

https://www.zetatalk.com/newsletr/issue592.htm

- The Bitcoin craze which started in

2009 has now spread to other, newer Cryptocurrencies, all

likewise unregulated.

- Crypto Downturn

https://poleshift.ning.com/profiles/blog/

- The crypto market suffered a sharp

downturn on December 1, 2025, with over $400 million in

liquidations occurring in just one hour. Bitcoin and other

major cryptocurrencies saw steep price drops, triggering

widespread concern across the market. Zetas, Right,

Again! What Happened in the Crypto Market? Bitcoin (BTC)

plunged below $87,000, erasing a week’s gains in a single

candle. It dropped nearly $4,000 in under two hours.

Ethereum (ETH) fell over 6%, landing around $2,828, while

Solana (SOL) and others also saw similar declines. The

total crypto market capitalization dropped to $2.92

trillion, down 5.26% in 24 hours. Liquidations exceeded

$400 million, primarily from long leveraged positions, as

traders were caught off guard by the sudden volatility.

- President Donald J. Trump

Establishes the Strategic Bitcoin Reserve and U.S. Digital

Asset Stockpile

March 6, 2025

https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet

- The Order creates a Strategic

Bitcoin Reserve that will treat bitcoin as a reserve

asset. The Strategic Bitcoin Reserve will be capitalized

with bitcoin owned by the Department of Treasury that was

forfeited as part of criminal or civil asset forfeiture

proceedings. The United States will not sell

bitcoin deposited into this Strategic Bitcoin Reserve,

which will be maintained as a store of reserve assets. The

Secretaries of Treasury and Commerce are authorized to

develop budget-neutral strategies for acquiring additional

bitcoin, provided that those strategies impose no

incremental costs on American taxpayers.

ZetaTalk Confirmation

12/4/2025: We

predicted when Bitcoin and other cryptocurrencies first

emerged that they would prove to be vulnerable

and thus ephemeral. Cryptocurrencies are not backed by

any country, thus the system can go poof with no

one held accountable. Unlike the USD, which the FDIC

guarantees up to $100,000 if a bank fails, or where a Plunge

Protection Team can calm a plunge, cryptocurrencies have no

brakes. They promise quick profits but also hold great risk.

But President Trump has

addressed the reality of Bitcoin and other cryptos with his

Strategic Bitcoin Reserve to hold any Bitcoin arriving as a

result of a civil suit. Where the USD or other currencies

might plunge in value to the extent that they are no longer

used as a medium of exchange, Bitcoin is likely to remain as a

link between Central Bank supported currencies and a frank

Barter System.

|